Resources and insights

Get the knowledge your business needs to succeed, from the experts that know it best.

ebook

Smarter cloud, smarter spending

Hybrid IT brings flexibility—but also complexity. Unchecked cloud spending, siloed teams, and unpredictable bills can slow growth and limit innovation. FinOps helps you change that.

In this ebook, Flexential and Tango share practical insights for mastering financial operations in the cloud. Learn how to:

- Gain full visibility into multi-cloud costs

- Build collaboration between IT, finance, and procurement

- Identify waste and optimize workloads

- Implement governance and automation for ongoing savings

Featuring insights from Flexential and Tango experts, this guide walks you through real-world FinOps success stories and the steps to start your own journey—without the complexity.

ebook

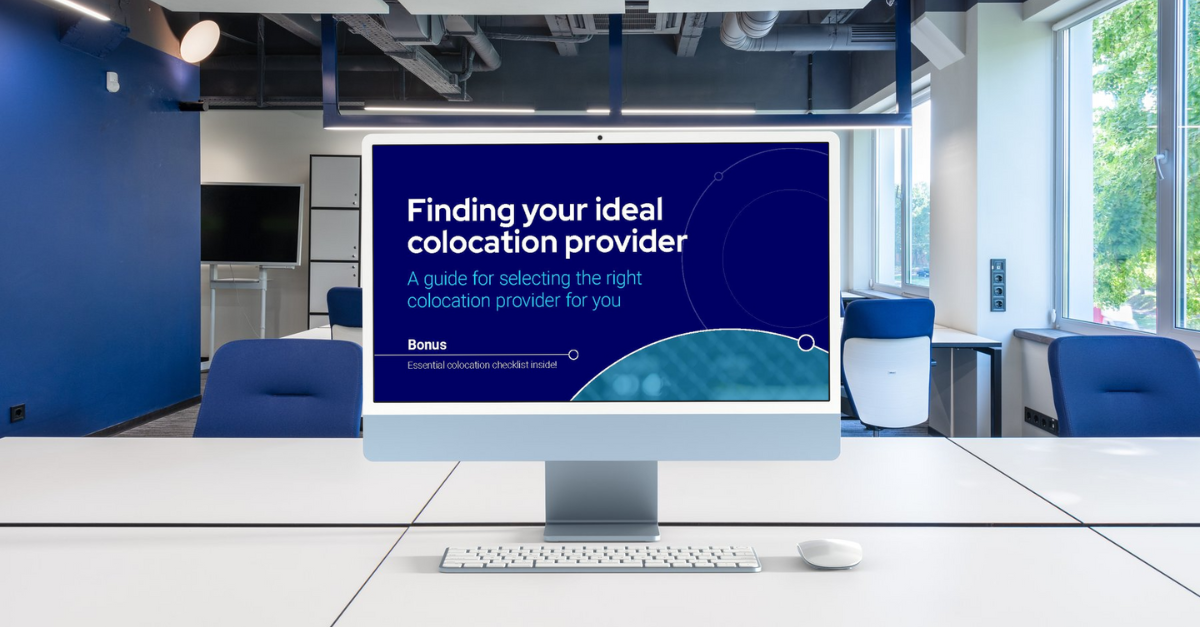

Finding your ideal colocation provider

A guide for selecting the right colocation provider for you

Choosing the right colocation provider is crucial to the success of your IT infrastructure strategy. Our comprehensive guide walks you through the essential factors to consider—from reliability and scalability to security and compliance. Use this checklist to make an informed decision and ensure your provider meets all your business requirements. Download the guide now and choose your provider with confidence.

Key takeaways:

- Understand the importance of provider reliability and financial stability.

- Evaluate critical security measures, compliance certifications, and audit processes.

- Assess location needs, scalability options, and network connectivity.

- Learn about energy efficiency, sustainability, and operational resilience.

- BONUS! Access an essential colocation checklist to help guide your decision.

Download the guide to ensure you select the right colocation provider for your business.

ebook

Plot your path to the best cloud choice for your business

Navigating hosted private cloud, multi-tenant cloud, and hybrid cloud options

Choosing the right cloud strategy is critical for balancing security, cost, and performance. But with multiple options available, how do you determine which model best aligns with your business needs?

Our latest eBook helps IT decision-makers explore hosted private cloud, multi-tenant cloud, and hybrid cloud to find the best fit for their infrastructure.

In this Ebook, you'll discover:

- The key differences between Hosted Private, Multi-Tenant, and Hybrid Cloud

- How to optimize security, compliance, and cost in your cloud strategy

- Enterprise use cases for each cloud model

- Strategies for future-proofing your cloud investment

Download the Ebook today and map out your best cloud path.

Dive deeper into key topics and trends to help you get the performance, reliability, and interconnectivity your business needs.