Tier 2 Data Center Markets: The Benefits Behind Location

Secondary and tier 3 data center markets are meeting rapidly growing demand for data center space and power as businesses continue to focus on digital transformations and as data creation, consumption and storage continue to surge.

In 2022, 94 zettabytes of data were created globally. With 13.14 billion connected devices across the globe, this number will continue to climb. However, long-standing primary data center markets are unable to keep pace with this rising demand, prompting hyperscalers and enterprises to leverage “second tier” markets to support their infrastructure and critical workloads.

What is a Secondary Data Center Market?

A secondary data center market is an area located outside of traditional, core data center locations such as Northern Virginia, Silicon Valley, New York City and Chicago. While tier 2 locales have historically had less of a data center presence, they have become magnets for data center development thanks to ample land, power, and water availability; lower energy costs; and access to clean energy sources.

Trends Driving Enterprises to Secondary Data Center Tiers

Secondary data center markets are gaining attention in response to a series of trends that are driving enterprises and hyperscalers beyond primary markets.

Demand is Outpacing Capacity

With intensifying digitalization, demand for data center services is surging. Data centers in primary markets are oversubscribed and unable to meet rising needs. Lacking both the available land to build new facilities and the electricity to power them, these markets remain constrained. In fact, Dominion Power recently notified its Northern Virginia customers that it could not meet data center power demand in the region. This is driving data center operators and hyperscalers to secondary markets that have access to the necessary land and power to meet surging capacity requirements.

The Work-Life Landscape has Shifted

COVID-19 greatly altered the digital landscape, introducing a remote-work environment that is here to stay. During the pandemic, many individuals also moved away from major cities for an improved cost of living and quality of life. With more people living and working outside of core locations, computing has become decentralized.

Despite this dispersed landscape, end users still need low-latency access to work productivity suites such as Microsoft Office and Google Teams, corporate data, media streaming services, and any number of other applications to remain productive and entertained. This is particularly crucial to support the growing use of real-time applications such as video conferencing, autonomous vehicles, stocking trading, live broadcasting, and multi-player gaming. While primary data center markets cannot deliver the same rapid delivery speeds across this more distributed user plane, secondary markets allow enterprises to position compute closer to end users to address latency and performance requirements.

The Shift in Data Gravity

As hyperscalers establish presences in high-growth tier 2 markets, enterprises that utilize their services follow them to achieve low-latency connectivity. This dynamic alters data gravity—which has historically been in core markets—and builds a powerful ecosystem within these second-tier areas.

Improved Infrastructure

Core data center markets once held a monopoly on robust fiber connectivity and energy delivery. However, as fiber and power capacities have spread into more regional areas, it has opened the gates to allow secondary locations to compete with tier 1 markets. As an added perk, these resources are less expensive than in primary tier 1 markets.

Geopolitical and Government Influences

The geopolitical landscape is also increasing demand for data center services within the U.S. As global unrest and security risks continue to threaten overseas businesses, many enterprises are repatriating their operations to the States, further straining capacity. Government programs are also increasing demand within the U.S. The CHIPS and Science Act of 2022 offers Federal aid to the semiconductor industry to construct U.S.-based manufacturing facilities. Companies like Micron and Intel are building facilities in secondary markets to take advantage of this aid as well as the additional tax incentives offered within these areas.

How Secondary Data Center Markets Benefit Enterprises

Recognizing the challenges of traditional data center tiers and markets—as well as the changing digital business landscape—data center operators and hyperscale cloud providers are building facilities in high-growth secondary markets such as Hillsboro, Oregon; Minneapolis, Minnesota; and Nashville, Tennessee that offer the acreage, renewable power and cooling options and diverse interconnections. While a ready supply of land and power are the principal drivers attracting organizations to these locations, these regions also offer additional benefits.

Reduced Costs

Cost is a key driver for every business. Secondary markets offer lower energy and real estate costs than core markets to minimize total cost of ownership (TCO). Many of these markets also offer attractive state and county tax incentives for additional cost savings. For example, Oregon does not levy a sales tax, and Arizona, Georgia, and Minnesota offer tax abatements to data center operators—and potentially their customers.

Room to Scale

Moving data centers is complex, time-consuming and expensive, and businesses want to avoid relocating their environments because of capacity issues. Before investing in infrastructure in tier 2 locales, data center operators thoroughly vet areas to ensure the necessary land, power supply, cooling systems, and connectivity options are available to provide customers with the data center services they need to support existing workloads and projected demand.

Improved Sustainability

Enterprises are prioritizing sustainability and the use of clean energy, and some regional markets offer improved access to these energy sources. For example, Minnesota is ranked as a top area for wind turbines, while Oregon offers improved access to water sources than drought-prone California to enable hydroelectric power. These locations may also offer lower-cost locations for solar panel fields than states with higher real estate costs or less available acreage.

Limited Latency

While primary data center markets built their reputations on dynamic, low-latency connectivity options, the pandemic-altered digital landscape requires rapid data delivery to a broader range of locations. Regional markets support edge deployments that allow businesses to place data and processing closer to end users to ensure the performance of applications—especially as wearable devices and other real-time applications play increasingly critical roles in business and personal lives.

Flexential Secondary Market Data Centers

Flexential is a leader in the regional data center market, offering scalable, reliable data center services that meet the mounting demands of enterprises and hyperscale cloud providers. With an aggressive national growth strategy, Flexential is expanding its presence and supplementing its current capacity in the secondary market, adding 33 megawatts (MW) of critical power in 2022 to bring its national portfolio footprint to more than 3 million square feet and its overall capacity to 310MW across its fleet of 40+ data center in 19 markets.

Leveraging the FlexAnywhere® Platform and Flexential Interconnection, enterprises can gain access to a full suite of colocation, interconnection, cloud, data protection, and managed and professional services to support their evolving IT and business needs everywhere.

Atlanta

With three Atlanta facilities, Flexential offers a 380,000+ square-foot data center footprint and 30.5+ MW of total power capacity. These facilities serve as lower-cost alternatives to Northern Virginia deployments, offering proximity to hyperscalers and other enterprises with which many organizations are already doing business. The region also offers data center tax incentives, some of which apply to data center customers. Its newest facility, Atlanta – Douglasville, utilizes the Flexential water-free design and offers low power usage effectiveness (PUE) for improved sustainability and IT operations.

Hillsboro

Flexential currently operates four data centers in the Hillsboro/Portland, OR region, with plans for a fifth deployment underway. With 700,000+ square feet of data center space and 77+MW of power capacity, the Hillsboro data centers offer proximity to Silicon Valley and other expensive West Coast locations. The connectivity-rich area also offers low-latency connectivity to Azure, Google Cloud, and Amazon on the West Coast as well as subsea cabling that connects the region to Asia and beyond. A series of tax advantages, including no state sales tax and the Hillsboro Enterprise Zone, which offers qualified customers a rebate on the cost of IT equipment, offer additional value.

Minneapolis

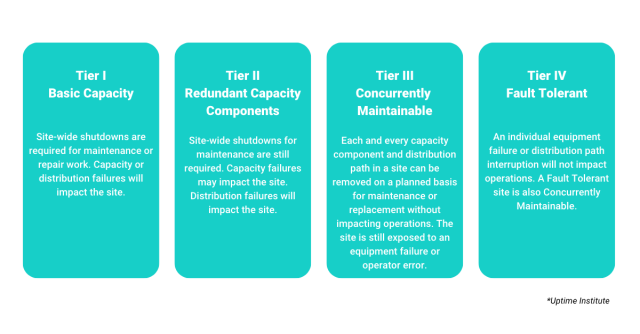

The Flexential Minneapolis – Chaska data center offers a 160,000+ square-foot data center footprint and 9+MW of critical power. The facility is designed to be concurrently maintainable and fault tolerant. Minnesota’s colder climate allows the facility to utilize outside cold air to regulate data center temperatures for added cost savings. Minneapolis’ central U.S. location also makes it ideal for servicing both Coasts. Additionally, the region offers data center-attracting tax abatements that may extend to colocation customers.

Nashville

Flexential is one of the largest multi-tenant data center operators in Tennessee. Its Nashville presence integrates three data centers for a combined 174,000+ square-foot data center footprint and 10.6+MW of critical capacity. Nashville’s low costs of living and energy are major draws to the market.

As businesses continue to leverage technology to meet corporate objectives and support a more distributed workforce and edge requirements, secondary data center markets will become increasingly powerful alternatives to core data center markets. These strategic deployments will continue to help organizations meet intensifying demands, minimize latency and ensure application performance—all at a lower cost point and with greater scalability than primary markets.

Reach out for a Flexential regional data center tour or learn more here.